Germany’s Position in the Global Vape Market: The ‘Eternal Third’ Unveiled

In the rapidly changing landscape of the global vape market, Germany has often been labeled as the “eternal third,” reflecting its consistently stable market position. However, this seemingly lighthearted moniker conceals a more complex narrative.

Historical Vape Market Stability and Recent Shifts

Historically, Germany has maintained a stable third-place ranking in the e-cigarette market. Over the past few years, the country has held a relatively steady position in terms of market share, sales, and brand influence. However, recent data from the China Customs in the first half of 2024 shows a slight decline in exports, with a total of $5.381 billion, down 1.82% from the same period last year.

The United States as the Main Growth Engine, Changes for Germany

According to customs data, the top ten export destinations for e-cigarettes in the first half of the year were the United States, the United Kingdom, South Korea, Germany, Russia, the Netherlands, Malaysia, Canada, Japan, and the United Arab Emirates. Notably, Australia dropped out of the top 10, and the United Arab Emirates entered the list.

Vape Market Dynamics and Consumer Preferences

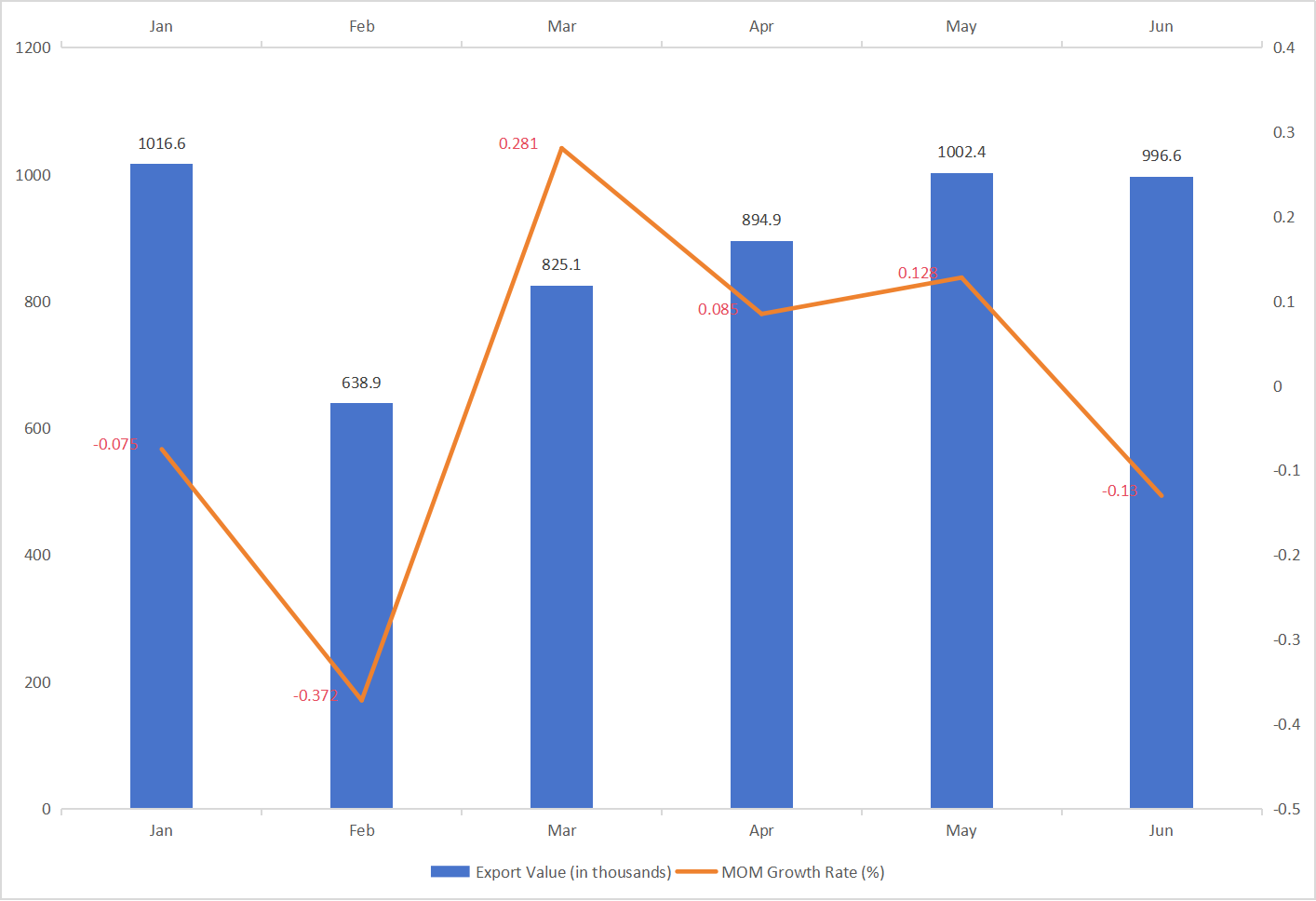

While Germany may not always secure a spot in the top three of China’s vape exports, the market demand remains. Particularly in March, the German market showed significant growth, reaching approximately $63.98 million, a month-on-month increase of 71.04%, indicating the market’s potential.

| E-cigarette exporting countries in the first half of 2024 | |||||||

|---|---|---|---|---|---|---|---|

| Land | Q1 2023 | Q2 2024 | YoY Growth Rate (%) | ||||

| Export Value (USD million) | Rank | YoY Growth Rate (%) | Export Value (USD million) | Rank | YoY Growth Rate (%) | ||

| United States | 149 | 1 | 27.16 | 181 | 1 | 33.72 | 21.92 |

| United Kingdom | 7.005 | 2 | 12.78 | 6.151 | 2 | 11.43 | -12.18 |

| South Korea | 3.129 | 4 | 5.71 | 3.721 | 3 | 6.91 | 18.93 |

| Germany | 4.227 | 3 | 7.71 | 3.401 | 4 | 6.32 | -19.54 |

| Rusland | 2.524 | 5 | 4.6 | 2.742 | 5 | 5.1 | 8.64 |

| Netherlands | 1.613 | 8 | 2.94 | 2.186 | 6 | 4.06 | 35.52 |

| Malaysia | 1.939 | 7 | 3.54 | 1.751 | 7 | 3.25 | -9.68 |

| Canada | 1.421 | 10 | 2.59 | 1.217 | 8 | 2.26 | -14.35 |

| Japan | 2.397 | 6 | 4.37 | 1.165 | 9 | 2.17 | -51.38 |

| United Arab Emirates | 1.054 | 12 | 1.93 | 1.032 | 10 | 1.92 | -2.27 |

However, by August, exports to Germany had declined to $56.32 million, down 4.47% month-on-month and 29.81% year-on-year. This overall decrease could be attributed to seasonal market fluctuations, changes in regulatory policies, or other macroeconomic factors.

Why Germany’s Position Shifted

In the global vape export arena, Germany has been a steady contender. However, recent export data suggests that South Korea and Russia are rapidly catching up, poised to take over and even surpass Germany in certain areas. This shift underscores the dynamic nature of the global vape market and the intense competition.

Regulatory Impact

Germany’s stringent regulatory policies on e-cigarettes have significantly influenced the market. Taxes on vaping devices have gradually increased, and regulations cover sales locations, age restrictions, product composition, and advertising, raising market entry barriers and promoting standardized development.

Market Trends and Consumer Preferences

The German vape market is undergoing changes. With growing health and environmental awareness among consumers, the market share of disposable vapes is declining, while reusable vaping products are on the rise. According to Eulerpool, the disposable vape market in Germany is showing a clear downward trend. ELFBAR leads the market with a share of over 50%, followed by Vuse and Juul.

Brand Dynamics and Market Performance

In terms of brands, ELFBAR dominates the German e-cigarette market with its design and price advantages. However, the competitive landscape is not static. Emerging vape brands like MOKI, VAPLAY, OXVA, and YOOZ are rising rapidly through product innovation and marketing strategies, challenging the status of traditional brands.

Perspective from Export Data

From the export data in July 2024, the top five export destinations (the United States, the United Kingdom, Russia, Germany, and South Korea) account for 62.9% of the total export value, with the United States remaining the largest market. The data indicates a downward trend in Germany’s vape exports, suggesting the rise of emerging markets.

From the perspective of export data, Germany’s vape market has not always been the “eternal third” in the first half of 2024, but has fluctuated, reflecting the dynamics and competitiveness of the global vaping device market. As the market continues to mature and consumer demands diversify, the future of Germany’s vape market will focus more on product quality and innovation while facing fiercer brand competition.